Table of Contents

In today’s fluid world, attaining financial freedom is a goal many strive for. With the year 2025 on the horizon, it’s more important than ever to explore the best passive income ideas that can help you make money effortlessly. Passive income not only provides an additional revenue stream but also offers the opportunity to build wealth, achieve financial independence, and enjoy a more secure financial future.

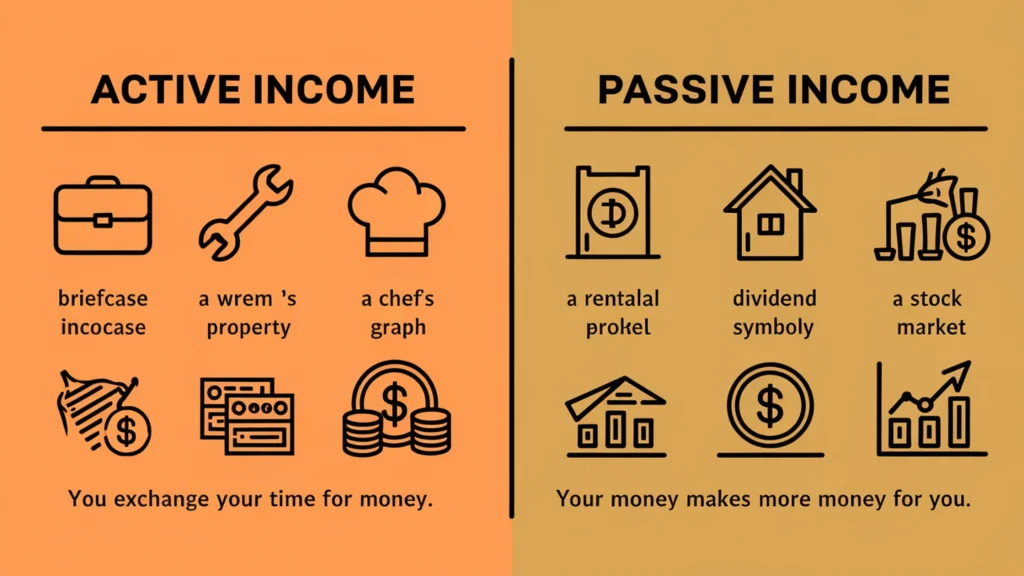

Passive income is essentially money earned with minimal effort on your part. Unlike active income, where you exchange time for money, passive income continues to generate revenue even when you’re not actively working. This allows you to diversify your income streams and create a safety net that can support you during uncertain times.

In this article, we will delve into 27 of the best passive income ideas for 2024. From real estate investments to digital products, we’ve compiled a comprehensive list that covers a wide range of opportunities. Whether you’re a seasoned investor or a beginner looking to dip your toes into the world of passive income, there’s something here for everyone.

So, let’s get started and discover how you can start building your wealth and achieving financial freedom with these top passive income strategies for 2024.

Key Takeaways

- Passive income provides financial freedom, allows for diversified income streams, and contributes to long-term wealth accumulation.

- The best passive income ideas for 2024 cover a wide range of opportunities, from real estate investments and financial investments to digital products and online ventures.

- Automated business models, licensing and royalties, and niche investments are additional avenues for generating passive income.

- Sustainable and green investments are becoming increasingly popular, providing passive income while contributing to a more environmentally-friendly future.

- Careful consideration of factors like initial investment, time commitment, risk vs. reward, and personal interests is crucial when selecting the best passive income ideas.

What is Passive Income?

Passive income is a type of earnings derived from activities in which you are not actively involved on a regular basis. Unlike active income, where you exchange your time and effort directly for money (such as a traditional job or freelance work), passive income allows you to earn money with minimal ongoing effort. This makes it an appealing option for those looking to diversify their income streams and achieve financial freedom.

Definition and Explanation

Passive income can be defined as income generated from assets or investments that require little to no daily involvement. It is money that works for you even when you’re not actively working. This type of income can come from various sources, including real estate, investments, online ventures, and more.

Difference Between Passive and Active Income

The primary difference between passive and active income lies in the level of effort required. Active income involves continuous work and time commitment, such as a 9-to-5 job or freelance projects. In contrast, passive income requires an initial setup or investment but yields returns with minimal ongoing effort. This distinction is crucial for understanding how to balance and diversify your income sources effectively.

Benefits of Generating Passive Income

- Financial Freedom: Passive income streams can provide financial security and independence, allowing you to cover your living expenses without relying solely on active work.

- Diversified Income Streams: Having multiple sources of income reduces financial risk and increases stability, especially during economic downturns or personal emergencies.

- Increased Wealth: Over time, passive income can significantly contribute to wealth accumulation and long-term financial growth.

- Flexibility: Passive income allows you to pursue other interests, hobbies, or even new business ventures, giving you more control over your time.

- Retirement Planning: Building passive income streams is an excellent strategy for retirement planning, ensuring a steady income flow in your later years.

Criteria for Selecting Best Passive Income Ideas

Choosing the right passive income streams is crucial for maximizing your earnings and minimizing risks. Here are some key criteria to consider when selecting the best passive income ideas for 2024:

Factors to Consider

- Initial Investment: Assess how much capital you need to start. Some passive income opportunities require significant upfront investments, while others can be started with minimal funds.

- Time Commitment: Evaluate the time needed to set up and maintain the income stream. Some ventures require ongoing attention, while others are more hands-off.

- Risk vs. Reward: Understand the potential risks and rewards associated with each idea. Consider the stability and predictability of the income.

- Scalability: Determine if the income stream can grow over time. Scalable opportunities allow you to increase your earnings without a proportional increase in effort.

- Personal Interest and Expertise: Choose ideas that align with your interests and expertise. This will make the process more enjoyable and increase your chances of success.

Risk vs. Reward Assessment

Balancing risk and reward is essential when selecting the best passive income ideas. High-reward opportunities often come with higher risks, while safer options may yield lower returns. Consider your risk tolerance and financial goals when evaluating each idea.

Initial Investment and Time Commitment

Identify how much time and money you’re willing to invest upfront. Some passive income streams, like real estate investments, may require substantial initial capital and ongoing management. Others, like creating digital products, might need more time in the beginning but less maintenance over time.

Real Estate Investments

Real estate has long been a popular choice for those looking to generate passive income. With various options available, it offers multiple avenues to build wealth and achieve financial stability. Here are some of the best real estate investment opportunities for 2024.

Rental Properties

Owning rental properties is a classic way to earn passive income. By purchasing a property and renting it out, you can generate a steady stream of rental income.

Overview and Benefits: Rental properties provide consistent monthly cash flow and potential appreciation in property value over time.

Steps to Get Started:

- Research and choose a profitable location.

- Secure financing or save for a down payment.

- Purchase the property and prepare it for tenants.

- Find reliable tenants and manage the property or hire a property management company.

Real Estate Crowdfunding

Real estate crowdfunding allows you to invest in real estate projects with relatively small amounts of money. This method pools funds from multiple investors to finance properties.

- Definition and How It Works: Crowdfunding platforms connect investors with real estate developers seeking funding for projects. Investors earn a share of the profits based on their contribution.

- Popular Platforms to Consider: Explore platforms like Fundrise, RealtyMogul, and CrowdStreet.

Real Estate Investment Trusts (REITs)

Investing in REITs is a simple and effective way to earn passive income from real estate without directly owning properties. REITs are companies that own, operate, or finance income-producing real estate.

- Explanation and Advantages: REITs allow investors to buy shares in commercial real estate portfolios, offering dividends and potential capital gains.

- How to Invest in REITs: REITs can be purchased through brokerage accounts, similar to stocks. Look for publicly traded REITs for liquidity and transparency.

Financial Investments

Financial investments are an effective way to generate passive income with the potential for significant returns. Here are some top financial investment opportunities to consider for 2024.

Dividend Stocks

Investing in dividend stocks is a popular method for earning passive income. Dividend stocks are shares in companies that regularly distribute a portion of their profits to shareholders.

Understanding Dividend Stocks: Dividend stocks provide regular income through dividends and the potential for capital appreciation. Companies with a strong track record of paying dividends are typically more stable.

How to Pick Dividend-Paying Stocks:

- Research companies with consistent dividend payouts.

- Look for dividend yield and payout ratio.

- Diversify your portfolio to mitigate risk.

Bonds and Bond Funds

Bonds and bond funds offer a relatively safe way to generate passive income. By lending money to governments or corporations, investors earn regular interest payments over a set period.

- Types of Bonds: Explore various types of bonds, such as government bonds, corporate bonds, and municipal bonds.

- Benefits and Potential Returns: Bonds provide predictable income and are less volatile than stocks. Bond funds pool money from multiple investors to purchase a diversified portfolio of bonds.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending involves lending money to individuals or businesses through online platforms, earning interest on your loans.

- How Peer-to-Peer Lending Works: P2P platforms connect borrowers with investors, facilitating loans without traditional financial institutions. Investors earn returns through interest payments.

- Pros and Cons: P2P lending offers higher returns than traditional savings accounts but carries higher risk. Diversifying your loans across multiple borrowers can mitigate risk.

Digital Products and Online Ventures

Creating and selling digital products or launching online ventures are fantastic ways to generate passive income. These options often require initial effort but can provide ongoing revenue with minimal maintenance.

E-books and Audiobooks

Publishing e-books and audiobooks can be a lucrative passive income stream. By leveraging your expertise or creativity, you can create content that generates royalties over time.

Creating and Selling E-books: Write and self-publish e-books on platforms like Amazon Kindle Direct Publishing (KDP) and Apple Books.

Platforms for Distribution: Use platforms like Audible, Audiobook Creation Exchange (ACX), and Google Play Books for audiobooks.

Online Courses

Online courses are an excellent way to share your knowledge and earn passive income. Once created, courses can be sold repeatedly without significant additional effort.

- Developing and Marketing Online Courses: Create courses on topics you’re knowledgeable about and market them through social media, email lists, and partnerships.

- Platforms to Host and Sell Courses: Use platforms like Udemy, Teachable, and Coursera.

Blogging and Affiliate Marketing

Starting a blog can be a gateway to multiple passive income streams, including affiliate marketing, sponsored content, and ad revenue.

- Starting a Blog: Choose a niche you’re passionate about and create valuable content that attracts readers.

- Monetization Strategies: Earn money through affiliate marketing, sponsored posts, and display ads.

YouTube Channel

Creating a YouTube channel allows you to earn passive income through ad revenue, sponsorships, and affiliate marketing.

- Creating Content for YouTube: Develop engaging videos on topics you’re passionate about and optimize them for search.

- Monetization through Ads and Sponsorships: Join the YouTube Partner Program to earn from ads, and seek sponsorships from brands.

Print on Demand

Print on demand allows you to design products like t-shirts, mugs, and posters, which are produced and shipped only when orders are placed.

- Overview of Print on Demand: Create designs and upload them to platforms that handle production and shipping.

- Setting Up an Online Store: Use platforms like Shopify, Printful, and Redbubble.

Automated Business Models

Automated business models some of the best passive income ideas which allow you to set up systems that generate passive income with minimal ongoing involvement. These models leverage technology and streamlined processes to run the business operations, letting you focus on scaling and enjoying the returns.

Dropshipping

Dropshipping is an e-commerce business model where you sell products without holding any inventory. When a customer places an order, the supplier ships the product directly to them.

Explanation and Benefits: Dropshipping reduces the risk and costs associated with holding inventory. It also allows you to offer a wide range of products.

How to Start a Dropshipping Business:

- Choose a niche market.

- Find reliable suppliers through platforms like AliExpress, Oberlo, or Cj Dropshipping.

- Set up an online store using Shopify or WooCommerce.

- Market your store through social media and paid advertising.

Amazon FBA (Fulfillment by Amazon)

Amazon FBA allows you to store your products in Amazon’s fulfillment centers. Amazon handles storage, packaging, and shipping, making it easier for you to manage your business.

- How Amazon FBA Works: You send your products to Amazon’s warehouses, and they take care of the rest. This includes customer service and returns.

- Tips for Success:

- Choose high-demand products.

- Optimize your product listings with SEO-friendly titles and descriptions.

- Use Amazon’s advertising tools to increase visibility.

Licensing and Royalties

Earning passive income through licensing and royalties can be incredibly rewarding, especially for creative individuals and innovators. Here are some of the best ways to generate passive income in this category.

Patents and Inventions

If you have a unique idea or invention, patenting it can provide a steady stream of passive income through licensing agreements. Companies will pay to use your patented technology or product.

How to Patent an Idea:

- Conduct a patent search to ensure your idea is original.

- Prepare and file a patent application with the relevant authorities.

- Work with a patent attorney to navigate the legal complexities.

Earning Through Licensing: Once patented, license your invention to businesses or manufacturers who can use it in their products. This can result in regular royalty payments.

Music and Art Royalties

Creating music or artwork can provide ongoing royalties every time your work is used or sold. This is a popular option for artists, musicians, and creators.

- Creating and Licensing Music or Artwork: Produce music tracks, albums, or artwork and license them through various platforms.

- Platforms for Earning Royalties: Use platforms like Spotify, Apple Music, Shutterstock, and Getty Images to distribute your work and collect royalties.

Investment Platforms and Apps

With the rise of technology, investment platforms and apps have made it easier than ever to grow your wealth and generate passive income. Here are some of the top options to consider\.

Robo-Advisors

Robo-advisors are automated investment platforms that use algorithms to manage your portfolio. They provide a hands-off approach to investing, making it ideal for those who prefer minimal involvement.

- What are Robo-Advisors?: Robo-advisors offer personalized investment strategies based on your financial goals and risk tolerance. They automatically rebalance your portfolio and manage your investments.

Benefits and How to Use Them:

- Easy to use and accessible.

- Lower fees compared to traditional financial advisors.

- Regular portfolio rebalancing and tax-loss harvesting.

Savings Accounts and CDs

High-yield savings accounts and Certificates of Deposit (CDs) are low-risk ways to earn passive income through interest.

- High-Yield Savings Accounts: These accounts offer higher interest rates than traditional savings accounts. Look for online banks that typically provide better rates.

- Certificates of Deposit (CDs): CDs are time deposits that pay a fixed interest rate for a specified term. They offer higher returns than regular savings accounts but require you to lock in your money for a set period.

Miscellaneous Best Passive Income Ideas

In addition to the more conventional methods, there are several unique and creative ways to generate passive income. Here are some miscellaneous best passive income ideas that you can explore in 2024 before you enter 2025.

Renting Out Space

If you have extra space in your home or property, you can rent it out to generate passive income. This could include a spare room, garage, or even storage space.

- Rent Out a Room or Storage Space: Platforms like Airbnb and Neighbor make it easy to list and rent out your available space.

- Benefits: This method provides regular income with minimal effort, especially if you live in a desirable location.

Vending Machines

Investing in vending machines can be a lucrative passive income stream. By placing machines in high-traffic areas, you can earn money from sales without much ongoing involvement.

- How to Start a Vending Machine Business:

- Research and choose profitable locations.

- Purchase or lease vending machines.

- Stock the machines with popular products.

- Monitor and refill as needed.

Potential Earnings and Maintenance: Earnings depend on the location and product selection. Regular maintenance is required to ensure the machines are stocked and functioning properly.

Car Rentals

If you have a vehicle that you don’t use often, renting it out can be a great way to generate passive income. Platforms like Turo and Getaround facilitate car rentals, connecting you with potential renters.

- Renting Out Your Car: List your car on rental platforms and set your availability and pricing.

- Platforms Like Turo and Getaround: These platforms handle the booking process and provide insurance coverage for your vehicle.

Investing in a Business

Becoming a silent partner in a business can provide passive income through profit sharing. This involves investing capital in a business without being involved in its day-to-day operations.

- Becoming a Silent Partner: Find businesses looking for investment and negotiate your share of the profits.

- Earning Through Business Profits: Receive regular income based on the business’s performance.

Content Creation and Monetization For Passive Income

Podcasting

Starting a podcast can be a fun and profitable way to earn passive income. Once you’ve created and uploaded your episodes, they can continue to generate revenue through various monetization methods.

- Starting a Podcast: Choose a niche topic, plan your episodes, and record your content. Distribute your podcast on platforms like Spotify, Apple Podcasts, and Google Podcasts.

- Monetization through Sponsorships and Ads: Partner with brands for sponsorships or join ad networks to earn money based on your listenership.

Stock Photography

If you have a knack for photography, selling your photos online can provide a steady stream of passive income. Websites and businesses constantly need high-quality images for their content.

- Selling Your Photos Online: Upload your photos to stock photography websites like Shutterstock, Adobe Stock, and iStock.

- Best Platforms to Use: These platforms handle the sales and distribution, allowing you to earn royalties each time your photo is downloaded.

Mobile App Development

Developing and monetizing mobile apps can be a significant source of passive income. Once your app is built and published, it can generate revenue through various channels.

- Developing and Monetizing Mobile Apps: Create apps that solve problems or entertain users. Monetize through in-app purchases, subscriptions, and ads.

- App Stores and Advertising Options: Publish your app on Google Play and the Apple App Store, and use ad networks to generate income.

Sustainable and Green Investments

As environmental awareness grows, sustainable and green investments have become increasingly popular. These investments not only generate passive income but also contribute to a more sustainable future. Here are some top green investment opportunities to take into consideration.

Investing in Renewable Energy

Renewable energy investments involve funding projects that produce energy from sustainable sources like solar, wind, and hydro. These investments can be made directly or through various financial instruments.

Solar and Wind Energy Investments: Invest in companies that develop and operate solar and wind farms. These companies often provide dividends to shareholders.

Green Mutual Funds and ETFs: These funds pool money from multiple investors to invest in a diversified portfolio of renewable energy projects and companies.

Solar and Wind Energy Investments: Invest in companies that develop and operate solar and wind farms. These companies often provide dividends to shareholders.

Green Mutual Funds and ETFs: These funds pool money from multiple investors to invest in a diversified portfolio of renewable energy projects and companies.

Niche Investments

Niche investments offer unique opportunities to generate passive income by investing in rare and valuable items. These investments can be highly rewarding, but they require specialized knowledge and careful consideration.

Collectibles and Antiques

Investing in collectibles and antiques can be a profitable way to generate passive income. This includes items like stamps, coins, vintage toys, and artwork.

Investing in Rare Items: Research and purchase rare items that have a history of appreciating in value. This requires knowledge of the market and an eye for valuable pieces.

Understanding the Market: Keep an eye on trends and market demand for specific collectibles. Attend auctions, join collector groups, and consult experts to stay informed.

Potential Profits: The value of collectibles can increase significantly over time, providing substantial returns. However, it’s important to invest wisely and be patient.

Conclusion

Passive income is a powerful tool for achieving financial freedom and stability. By diversifying your income streams and investing in opportunities that generate earnings with minimal ongoing effort, you can build wealth and secure your financial future. The 27 best passive income ideas I’ve explored in this article offer a wide range of options to suit different interests, expertise, and investment levels.

Whether you choose to invest in real estate, create digital products, or explore automated business models, the key is to take action and start building your passive income streams today. Remember, the journey to financial independence begins with a single step. So, choose the best passive income ideas that resonate with you, do your research, and begin your path to financial freedom.

I hope this guide has inspired you and provided valuable insights into the best passive income ideas for 2024. If you found this article helpful, please share it with your friends and family. And don’t hesitate to leave a comment with your thoughts or questions.